An Owner/User commercial real estate purchase presents a meaningful opportunity for local businesses seeking to secure a physical asset that suits their specific operational needs. Understanding Nevada’s current market landscape and financing options is essential for business owners aiming to make informed investment decisions. A well-planned purchase can position a company for stability and growth, providing both location control and long-term financial benefits. This article outlines key financing trends and loan structures in Nevada’s commercial real estate market to guide businesses through this process.

Financial institutions have become more open to lending for commercial property purchases, reflecting increased confidence in the market’s prospects. Interest rates on commercial loans have grown more favorable, easing the cost burden on buyers. This shift supports businesses ready to invest in owner-occupied real estate, facilitating access to capital with manageable repayment terms. Favorable lending conditions encourage businesses to consider property acquisition as a viable step towards operational control and asset building.

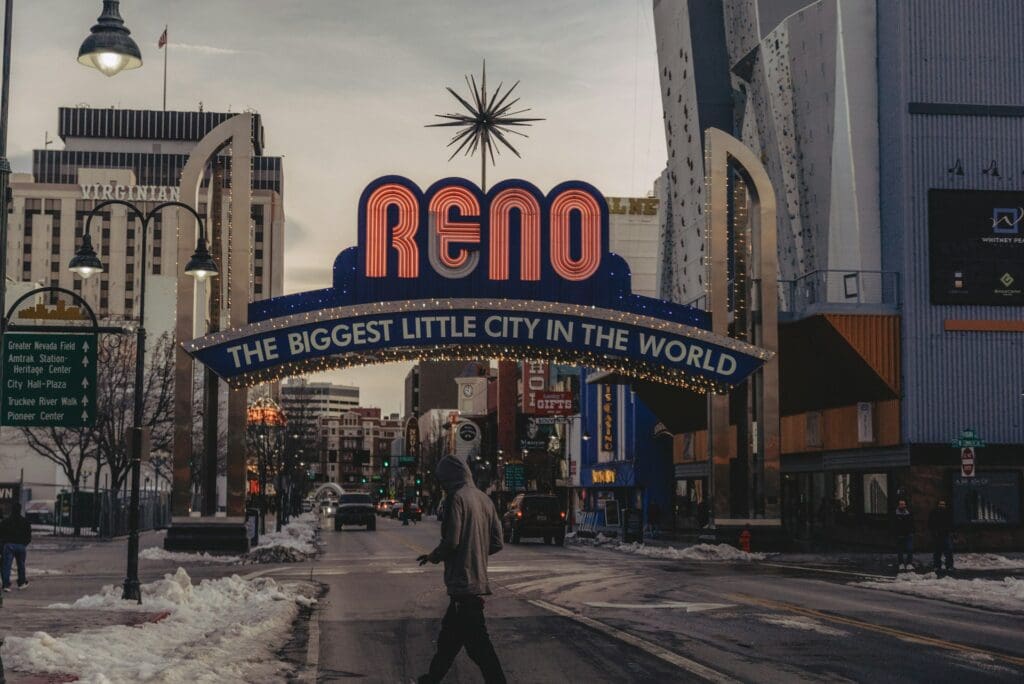

The willingness of lenders to finance commercial properties extends to a variety of business types, aligning loan products with specific market demands. Banks and other financial sources weigh a property’s potential and borrower’s business stability when approving loans. This trend benefits local enterprises in Reno and other Nevada markets, enabling them to secure loan approvals that might have previously been difficult to obtain. Loan accessibility now better reflects the realities of today’s business environment.

With interest rates trending positively, businesses can anticipate more predictable monthly payments over the loan term. Fixed and variable rate loan options are tailored to meet the risk tolerance and financial strategies of commercial buyers. Such flexibility is crucial for owner/user purchasers, enabling them to align financing with their cash flow and growth goals. Improved lending terms make it possible to move from renting to ownership with greater financial confidence.

Conventional commercial loans typically require as little as a 15% down payment, while Small Business

Administration (SBA) loans often demand a down payment as low as 10%, or in certain situations, even Zero down payment. This flexibility in initial capital outlay can lower barriers for business owners eager to invest in property. Each loan type offers a unique balance between upfront costs and qualification criteria, tailored to different business profiles and needs. Understanding these differences assists buyers in selecting the loan best suited to their financial capacity.

SBA loans are designed specifically to support small to mid-sized businesses, sometimes allowing for lower equity requirements to encourage ownership transition. Their structured terms can ease entry into a commercial real estate purchase for businesses lacking substantial upfront capital. However, SBA loans might have more stringent documentation and approval processes compared to conventional financing. Awareness of requirements guides business owners toward the mortgage solution that enables smoother application and closing.

Conventional loans are often preferred by businesses able to provide a higher down payment, frequently offering more competitive interest rates than SBA loans. These loans generally cater to borrowers with strong credit profiles and well-established financial histories. Such conditions can translate into better loan terms and fewer restrictions on property use. Knowing when a conventional loan may be advantageous helps businesses optimize financing costs.

Certain commercial uses, like medical facilities for example, can receive loan terms that are even more advantageous due to their perceived stability and community importance. Lenders may offer lower interest rates, longer amortization periods, or reduced down payment requirements for these properties. Aligning the property’s intended use with a lender favorable to that sector can significantly improve financing conditions. Business owners should identify lenders specializing in or welcoming medical or other specialized commercial properties to maximize benefits.

This tailored lending approach reflects lenders’ confidence in sectors with steady demand and predictable cash flow. Procuring a loan through a lender aware of such specific uses often smooths the underwriting and approval process. It is recommended to engage with financing partners early to ensure that loan terms align well with the property’s intended purpose. Strategic lender alignment mitigates financial and operational risks post-purchase.

The importance of choosing a lender who understands and supports the borrower’s business sector cannot be overstated. A lender familiar with the unique challenges and opportunities of a medical or similarly specialized commercial property can offer customized solutions. These solutions might include flexible repayment schedules or refinancing options structured around the business’s cash flow cycles. Optimal lender alignment enhances the likelihood of a successful owner/user transaction.

SBA loans typically include prepayment penalties, which may affect a business’s financial flexibility if early payoff is planned. These penalties compensate the lender for lost interest when loans are repaid ahead of schedule. Understanding such conditions is critical for businesses anticipating changes in capital needs or potential refinancing. These penalties tend to range based on loan terms and payoff timing.

In contrast, many conventional commercial loans do not have prepayment penalties, offering greater repayment flexibility. The absence of penalties can enable businesses to reduce debt early when extra funds become available, improving financial agility. This feature may be particularly important for companies emphasizing debt management as part of their growth strategy. Considering loan structures with or without prepayment penalties helps business owners align financing with their long-term plans.

Evaluating the presence or absence of a prepayment penalty is an essential piece of the decision-making process for loan selection. Business owners should factor in expected liquidity and growth scenarios to ensure the financing arrangement remains advantageous through the loan lifespan. Consultation with financial advisors or loan specialists can clarify these implications before committing to a loan. Thorough awareness of prepayment conditions strengthens confidence in the chosen financing route.

Purchasing commercial real estate that is Owner-Occupied in Nevada requires a clear understanding of the local lending environment and available financing options. Current trends favor accessible lending with moderate interest rates, while down payment requirements vary by loan program and lender preference. Aligning lender choice with specific property use enhances financing benefits, particularly for specialized sectors like manufacturing or medical facilities. Awareness of loan terms such as prepayment penalties is crucial for selecting the most advantageous financial path. Local businesses equipped with this knowledge can better strategize property acquisitions that support long-term operational and financial objectives, making it timely and prudent to engage experienced financing partners to explore tailored owner/user commercial real estate opportunities. Reach out today to explore tailored financing solutions and secure the right commercial property that positions your business for lasting growth in Nevada.